Traders are often confronted by mixed signals.

Personally, when I have to choose between something straightforward

or something complex – simple is better.

For example, when large "Smart Money" traders show their directional bias, it often pays to follow in their tracks.

Another technique would be to bet against the smaller retail "Dumb

Money" traders (because, historically, they are often wrong at major

turning points.

However, if I have to decide between following "Smart Money" or doing

the opposite of what "Dumb Money" does … then in the absence of other

information, following Smart Money wins because it is more

straightforward and simpler.

Here is an example.

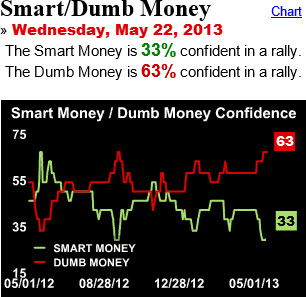

Smart Money – Dumb Money Confidence Index.

The

chart, below, compares the bets made by small traders (a.k.a. the "Dumb

Money"), to those of large commercial hedgers (a.k.a. the "Smart

Money").

In practice, Confidence Index readings rarely get below

30% or above 70% (they usually stay between 40% and 60%). When they move

outside of those bands, it's time to pay attention.

Even more

noteworthy is when there is a wide confidence spread with bullish bets

by the Dumb Money and bearish bets by the Smart Money. This type of

sentiment spread only happens a few times a year. We often get

substantial bullish reversals when that happens.

So, early last week, I took notice of this chart from SentimentTrader. The confidence spread it shows was pretty close to extreme levels.

Conventional trading wisdom says that Crowds are usually wrong at

turning-points. That doesn't mean they are wrong all the time (yet, as discussed, it makes sense to notice when the Smart Money clearly disagrees). So, after such a strong rally, this is the kind of data that causes me to pay closer attention.

The Markets had been selling-off a litte. Would this be a trend-break or a buying opportunity? Would Smart Money start actively making Bearish bets?

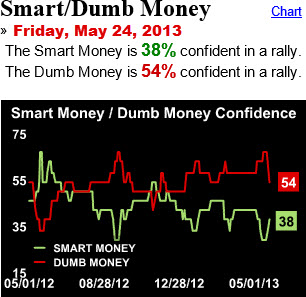

As the next chart shows, two days was all it took to get back to the status quo.

That is why trend following works. Price is the primary indicator, and until it breaks down, dips will be met with buying.