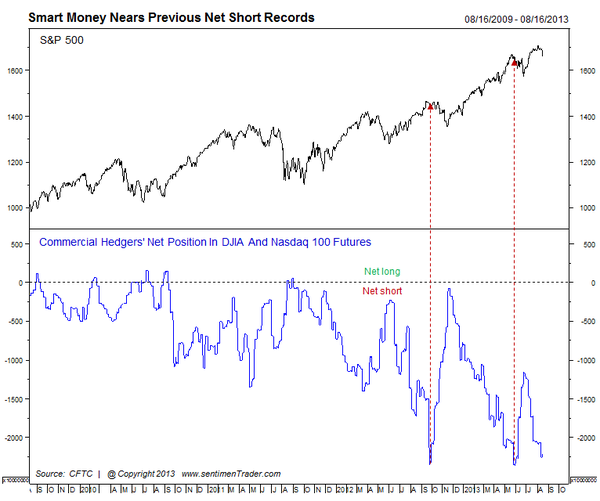

The CFTC releases data on the positions of "Smart Money"

commercial hedgers in the Dow Jones Industrial Average and Nasdaq 100

futures contracts.

According to SentimenTrader, extremes in

hedgers' positions in the futures have been good clues to the future

prospect for stocks in the intermediate-term.

For example, the chart below shows that there were heavy short positions last September, immediately

preceding a correction. In addition, there was a near net long position last November,

immediately preceding a rally. Finally, look at the record net short in

May right before another rough few weeks for stocks.

Obviously, we are close to those levels again.

Neither of the recent record short positions by commercials marked a major market peak. At its worst point during the next 4-8 weeks, the S&P 500 lost 4% – 6% before recovering … painful but not damaging.

Still, it is prudent to notice these kind of early indicators. However, remember that the trend has been bullish recently. Price is the primary indicator, and until it breaks down, expect dips to be met with buying.