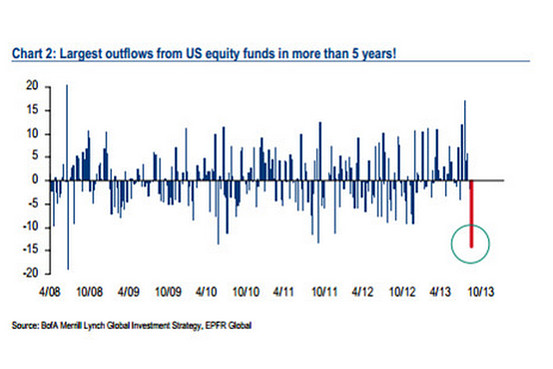

Talk about a flight to safety … August saw the biggest cash withdrawal from all U.S. exchange-traded funds in over three years. Likewise, scared investors triggered the largest outflows from US equity funds in the last five years.

Think of it as a flight to cash as retail investors dump risk assets.

The question is whether this marks the beginning of a new trend, or just nimble trading in the face of perceived danger?

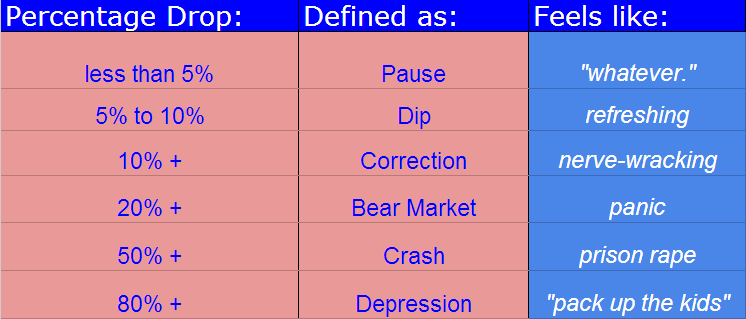

Joshua Brown, who blogs under the moniker "The Reformed Broker," tries to put things in perspective with this handy guide to market pull-backs.

With less than a five percent pull-back, it is a little early to trot out words like "correction."

As to whether we could see a correction (or worse, a bear market or even a crash), the answer is that it is always possible. Nonetheless, most corrections do not become crashes, and over time, every single one of them turned out to have been great buying opportunities.

Apparently not everyone is worried.

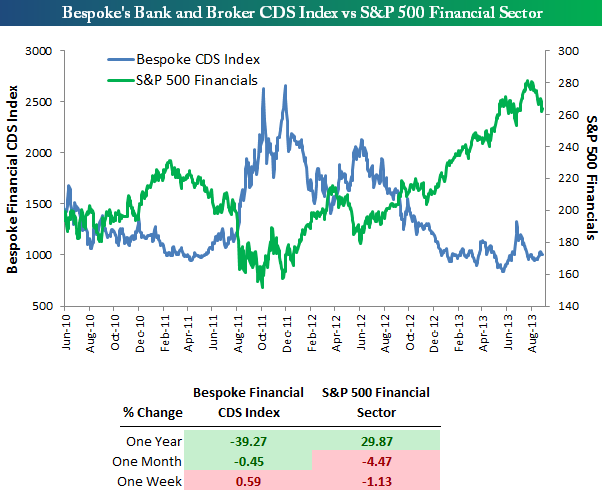

According to Bespoke's Bank and Broker CDS (credit default swap) Index, however, credit traders do not seem too worried.

The chart below measures default risk for the major financial firms around the world. Default risk for the financials typically spikes when stocks fall and vice versa.

Throughout 2013, the credit markets have become as comfortable with financial stocks as they've been since before the financial crisis of 2008/09. During the stock market pullback we saw in June, default risk picked up a bit, but during the most recent pullback, we've seen default risk trade sideways. Over the last month, the S&P 500 Financial sector is down 4.47%, but Bespoke's CDS Index is actually down 0.45% as well. So, for whatever the reason, the credit markets don't think there's reason to be concerned just yet.

What about you?