Image by Simon Miller via Flickr

Image by Simon Miller via Flickr

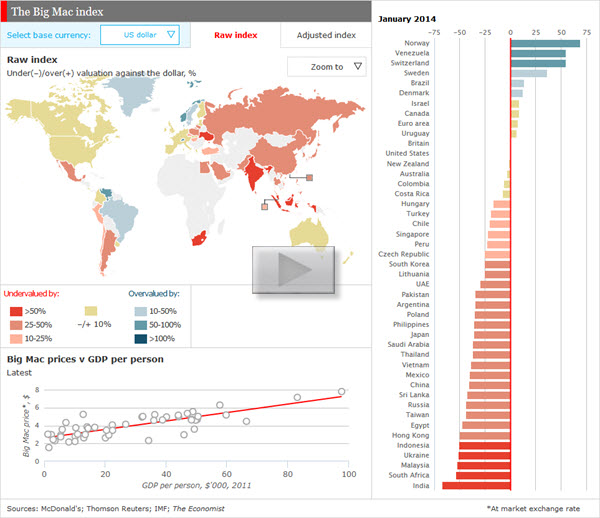

The Economist's Big Mac index seeks to make exchange-rate theory more digestible. They say, tongue-in-cheek, that it is arguably the world's most accurate financial indicator to be based on a fast-food item.

The Big Mac index is based on the theory of purchasing-power parity (PPP), according to which exchange rates should adjust to equalize the price of a basket of goods and services around the world. For them, the basket is a burger … a McDonald’s Big Mac.

According to this measure, the most undervalued currency is India's Rupee at about 67% below its PPP rate. In India, a McDonald’s Big Mac costs just 95 Rupees on average, the equivalent of $1.54 at market exchange rates. In America, the same burger averages $4.62.

The interactive graphic, below, shows by how much, in Big Mac PPP terms, selected currencies were over- or undervalued.

The index is supposed to give a guide to the direction in which currencies should, in theory, head in the long run. It is only a rough guide, because its price reflects non-tradable elements such as rent and labor. For that reason, it is probably least rough when comparing countries at roughly the same stage of development. The Economist has added an adjustment option to account for this in the interactive version of the data.