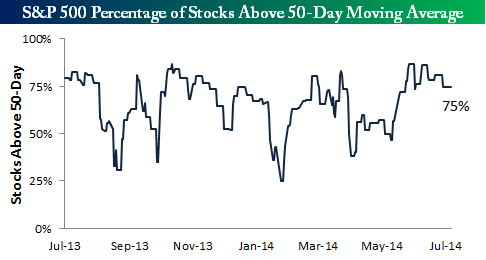

As shown below, 75% of the stocks in the S&P 500 are currently trading above their 50-day moving averages.

via Bespoke.

This indicator has been trending slightly downward for about a month now, but it hasn't fallen below the 75% mark for quite some time. Generally, whenever this breadth reading gets above the 80% level, the market is due for a breather.

In contrast, less than 50% of NASDAQ stocks are above their 200-day moving averages.

According to Martin Pring, that means that relatively few stocks are participating in the rally, and an even lower number are registering new highs. Moreover, there are currently slightly more stocks at new 52-week lows than highs, even though the NASDAQ is very close to its bull market high