The S&P 500 Index finally bounced.

Technicians sighed in relief as the S&P 500 had an oversold bounce near its April low support level. On a side note, Wednesday's price plunge marked a 62% retracement of the February-September rally.

The fact that the S&P 500 closed so far off its Wednesday low (in very heavy trading) also has the look of a potential "climax" bottom.

That's the good news.

The bad news is that the two day bounce on Thursday and Friday came on declining volume. In addition, the S&P 500 remains below its August low and 200-day moving average.

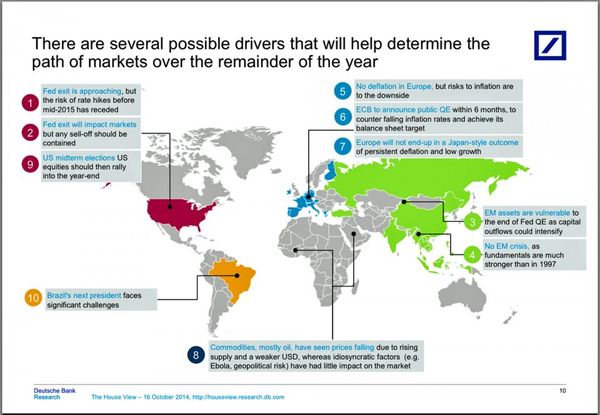

From a different perspective, there are many risks blame-worthy for the recent market volatility.