Have you noticed that people keep using the term "Selfie" to describe tons of pictures that aren't selfies?

Same with "Spoiler Alert" … People use the term to mean a variety of things now … few of which are actually spoiler alerts.

There is something similar happening in the financial world. People have latched on to the term "Black Swan".

Here is an example.

Wall Street was up for the sixth straight week, despite the oil rout.

What could go wrong? What are the "potential Black Swan events"?

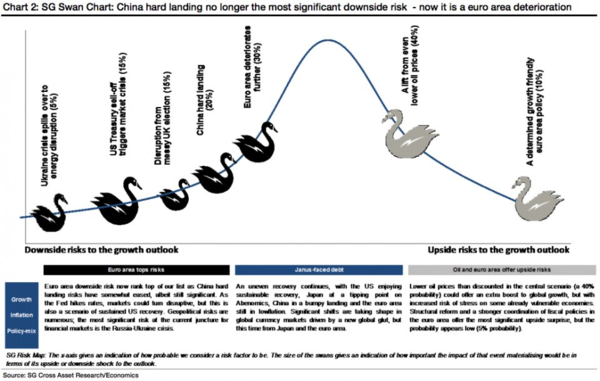

To annswer, Société Générale releases a quarterly chart of "Black Swan" risks.

The most recent example is below.

via BusinessInsider.

The concept of a "Black Swan" event takes its name from Nassim Taleb's 2007 book "The Black Swan."

But there's a slight problem with the chart above: acknowledging an event's possibility means it can't be a Black Swan.

The chart suggests that further deterioration in the economic situation in Europe poses a risk to the market. However, a "Black Swan" is an event or occurrence — a tail event, as Nassim Taleb would call it — that is so remote that it is completely unforeseen.

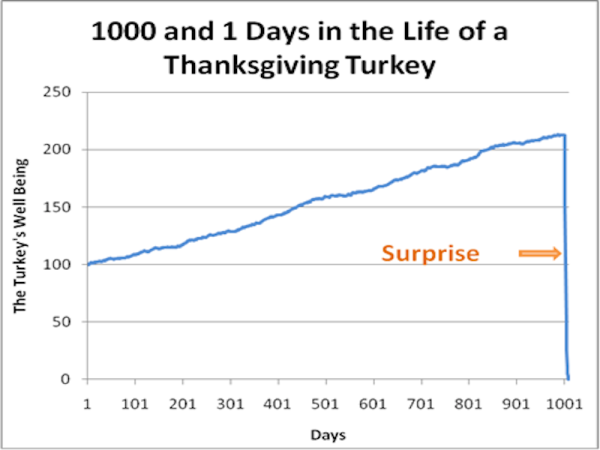

In his book, Taleb uses the Thanksgiving turkey as an example.

"Consider a turkey that is fed every day," Taleb writes. "Every single feeding will firm up the bird's belief that it is the general rule of life to be fed every day by friendly members of the human race 'looking out for its best interests,' as a politician would say.

"On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief."

Here's what it looks like in chart form.

This is basically the book's entire message wrapped up in one graphic.

"Consider that [the turkey's] feeling of safety reached its maximum when the risk was at the highest!" Taleb writes.

"But the problem is even more general than that; it strikes at the nature of empirical knowledge itself. Something has worked in the past, until — well, it unexpectedly no longer does, and what we have learned from the past turns out to be at best irrelevant or false, at worst viciously misleading."

And this is really what the problem of Black Swans is all about.

It isn't that we can't know the future, but that we delude ourselves into thinking we can … making forecasts about events that are inherently unforecastable and giving us false belief about what can (or will, or might) happen in the future.

When a Black Swan event occurs, it seems outside what had previously seemed possible.

However, Taleb suggests, the event only seems outside previous beliefs about what was possible because of how we arrived at those possibilities … by using the past to forecast the future.