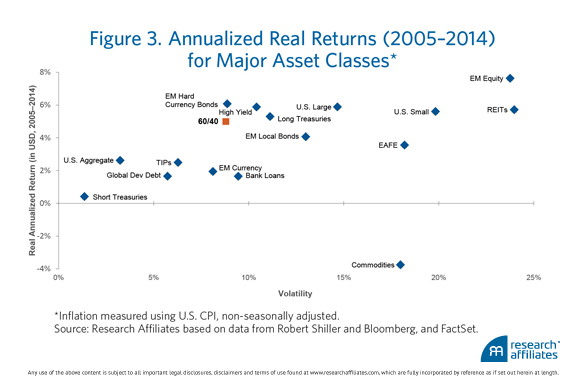

Research Affiliates takes a look back at the last ten years and calculates the annualized return of a classic 60% equity / 40% fixed income portfolio versus 16 pure asset classes on their own.

The 60/40 portfolio generated 7.2% annual returns (nominal) from 2005 through the end of 2014, edging out 9 of the 16 asset classes in their data set and with significantly less volatility than most as well.

via Research Affiliates.

How does that compare to what you expected?