On Thursday, the Nasdaq closed at its highest since March 2000.

On Friday, the S&P 500 Index traded at its intraday high (above 2120).

So, all is good … right? We should 'party like it's 1999'.

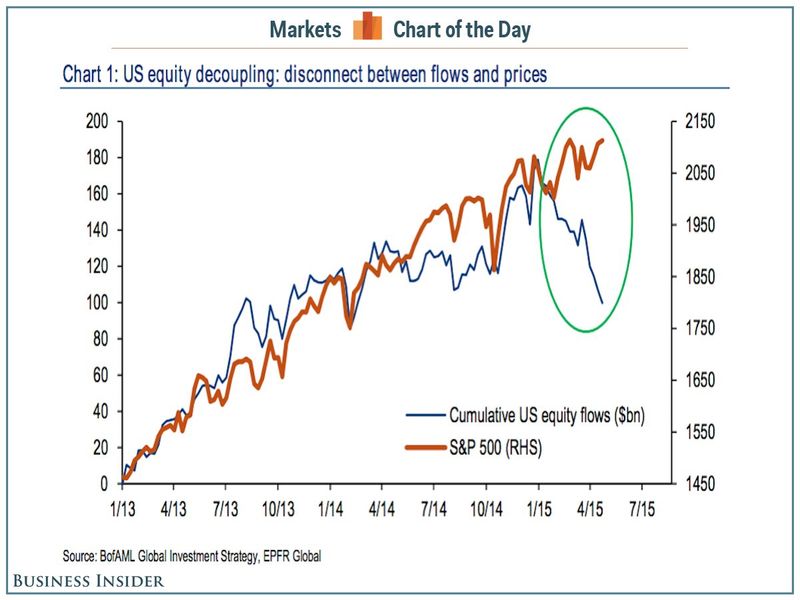

Some traders are noticing the disconnect between price and money flow in the US stock market.

via Business Insider.

A Bank of America/Merrill Lynch survey points out that US investors pulled $79B out of equities, year to date — including net outflows in 9 of the past 10 weeks — despite stock prices continuing to break new record highs.

As this imbalance grows, are we in danger of a correction?

What do you think?