Taxes on wage income vary heavily around the world.

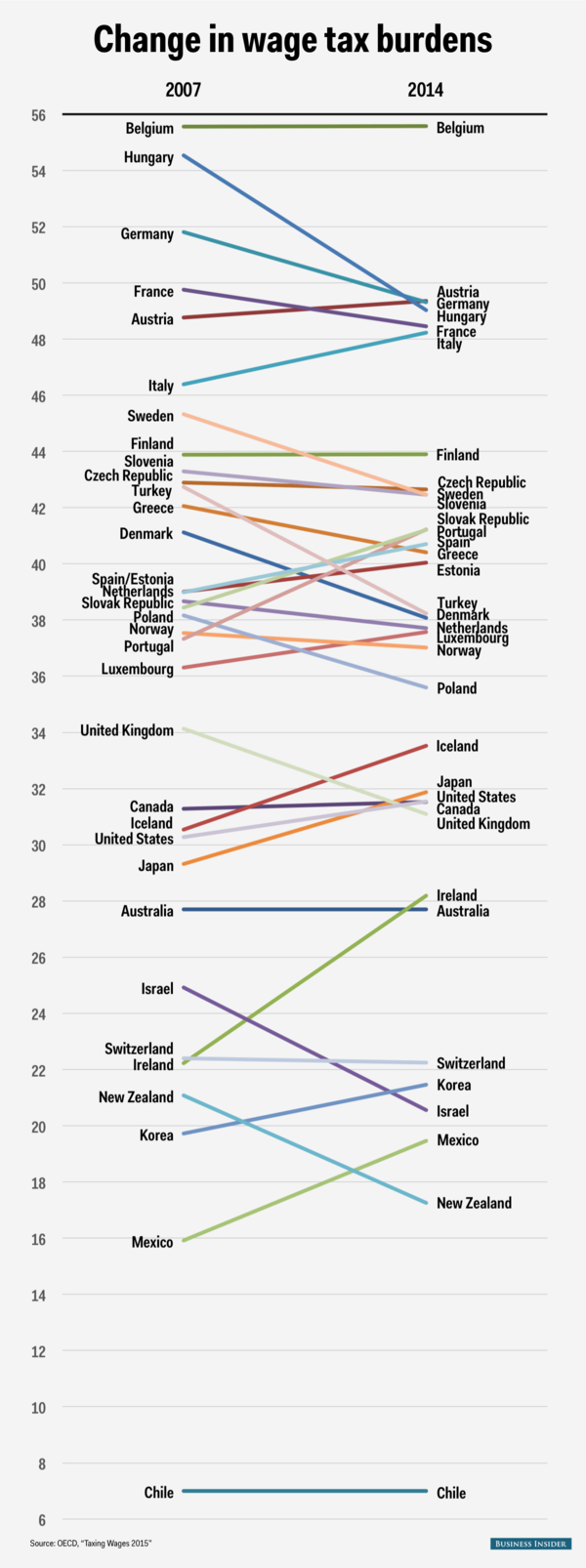

Here's how the tax wage burden for an average full-time single worker has grown or shrunk in each OECD country between 2007 and 2014. The chart also shows how different countries' tax burdens as a percentage of income compare to each other:

via Business Insider.

The OECD recently published a report comparing the tax burden on wages in the world's developed economies.

The chart highlights how tax burdens have changed for an average full-time worker between the time before the Great Recession and the present.

The country with the highest average tax burden — Belgium, at 55.6% of income — and the lowest — Chile, at just 7.0% — both saw no change between 2007 and 2014.

Other countries, however, saw larger shifts. The tax wedge in Hungary dropped 5.5 percentage points, from 54.5% in 2007 to 49.0% in 2014. Ireland's tax burden increased by 6.0 points, from 22.2% to 28.2%.