The Dow lost almost 500 points in the last two days. Longer term, the stock market has been down sharply since May 2; in fact, it has been down five of

the last six weeks. Several commentators note that the Dow experienced its worst June since 1930.

Moreover, with this decline, it has also given back all of the gains it made since September, 2006.

Also worth noting is that the Dow just made new lows for the year, entering “Bear Territory” by sinking more than 20% from its October peak. However the MACD’s downward momentum did not make new lows, even while the index price plummeted.

Perhaps more important, though, is that the Index broke below its 28-Year Up-Trend line.

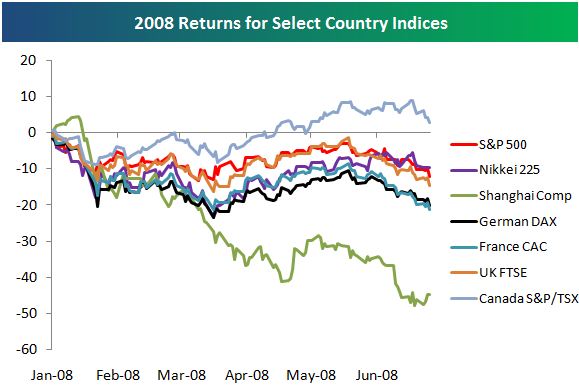

Also, Bespoke had an interesting chart comparing returns of various international indices. Here it is:

Finally, here are a few of the posts I found interesting this week:

- Market Tumbles, But VIX Still Not Showing Signs of Panic. (Big Picture & VIX and More)

- Consumer Sentiment Index Falls to lowest level in 28 years. (Bloomberg)

- Bearish Sentiment Rising, back near year highs (Bespoke)

- What should you do in the face of all the “doom and gloom”? (Kirk Report)

- How tenuous is the market? (Humble Student)

- In Canada no one knows Citibank is $17; they do know RIMM is down > 15%. (Howard Lindzon)

- The “Red Queen Trade:” all the running you can do, to keep in the same place. (Daily Speculations)

And a little bit extra …

- Trading Desks Turn to Video Game Technology to Speed Analytics. (Wall Street & Technology)

- Your Money and Your Brain (Phil’s Favorites)

- The Petabyte Age: Because More Isn’t Just More — More Is Different. (Wired)

- The New Name Game: Internet Naming Rules About to Change. (CNN)

- Will Brain Downloads will make lessons pointless? (Telegraph)

- The Philosophy of George Carlin (Financial Philosopher)