The rally has been strong. With the Dow Jones Industrial Average above 11,200, some are calling for an extended Bull market.

How Strong Has Breadth Been? The Answer is “Pretty Strong“.

With the advance over the past two months, the percentage of stocks above their 50-day moving average surged back towards prior highs. This chart shows that indicator is above 85% for the first time since January.

Some commentators take this as a strong bullish sign. It helps to think of this indicator like a momentum oscillator. As such, it can become overbought and remain overbought during a strong uptrend. While relatively high readings may be considered overbought, it is also a sign of strength as long as this indicator remains at high levels. However, as the chart shows, a sharp decline below this level would increase the odds of a correction unfolding.

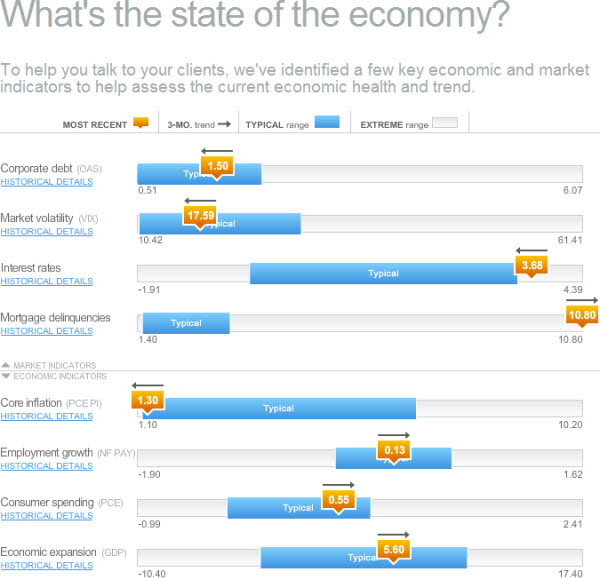

What is the State of the Current Economy?

Russell Investments publishes a nice summary of Market indicators. In general, it shows that interest rates are high, and mortgage

delinquencies are nearly off-the-chart, while most other indicators are

at

the low ends of their typical ranges.

Also worth noting, here, the VIX

decreased to its lowest month-end level in over 33 months.

When the SEC announced civil fraud charges against Goldman Sachs, its shareholders proceeded to lose $12 billion.

Here is what their stock is doing now.

If you are interested, the lawsuit stems from Goldman’s 2007 Abacus

deal. Here

is the presentation document they used to sell that deal.

Here are some of the news items about this that caught my eye:

- Why The SEC’s Theory Against Goldman Will Fail. (Forbes)

- Goldman

Sachs & the SEC – Greedy Until Proven Guilty. (Economist) - Goldman

Sachs and America’s Regulation & Supervision Paradox. (Globalist) - Financial

Reform? Obama to Wall St.: ‘Join Us, Instead of Fighting Us’. (NYTimes)

The Lighter Side of the Issue.

Did you hear that

Goldman Sachs made the Iceland volcano erupt? It did pretty well

shorting airlines.

The Goldman Sachs lawsuit and financial reform are becoming common topics of every-day humor.

It’s one thing when the business press writes about a topic, it’s another when it is the subject of a David Letterman Top-10 List, an on-going discussion on Jon Stewart, and the opening segment of Saturday Night Live. What do you think it means that this issue is now in the mass media?

Business Posts Moving the

Markets that I Found Interesting This Week:

- Intel Profits and Outlook Blow Past Expectations (DailyFinance)

- IBM Q1 Earnings Beat Street: Growth May Be Returning To The Tech

Sector. (InfoWeek) - Data Shows U.S. Service Sector is Expanding. (Time)

- Speculators Predict A 20% Collapse In

The NASDAQ. (BusinessInsider) - Louis

Navellier on Why the Market’s Rally Will End Next Week.

(Forbes) - More Posts

Moving the Markets.

Lighter Ideas and

Fun Links

that I Found Interesting This Week

- Third of U.S. Teens With Phones Text 100 Times a Day. (Reuters)

- Arizona ‘Birther Bill’ Requires Obama to Show Birth Certificate.

(Newser) - Next Generation iPhone Found in a Bar. Here Are the Details. (YNews)

- Cirque du Soleil Plans Michael Jackson Shows. (WSJ)

- Does Brain Training Work? Doing Anything is Better

than Nothing. (NewScientist) - More

Posts with Lighter Ideas and Fun Links.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=87460f6c-55a1-4482-b6ef-3f61e3509956)