The rally continues, and the S&P 500 has gotten back to new highs for the past year. Pretty

impressive on many fronts. How does it compare to other markets

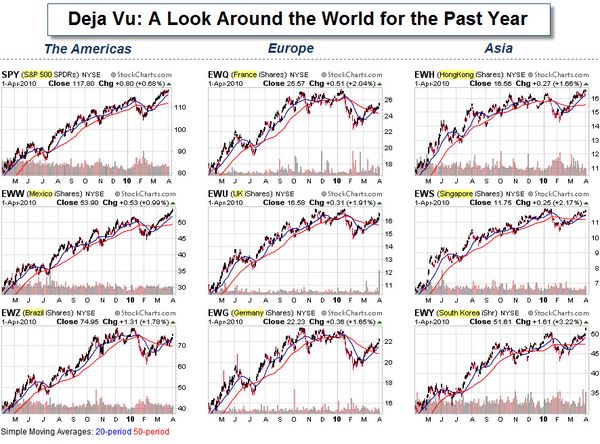

though? This chart shows how several other world markets have done in the past twelve months.

This quick glance around the globe shows remarkably similar performance across the markets. Note how closely the price patterns and peaks and valleys are to each other.

- Are these countries each really doing the same things right and

wrong? - Are world-wide expectations and responses really this similar?

To get a closer look for yourself, here is a link to the charts.

Perhaps more importantly, it brings up a

third question:

What's really causing the markets to behave so

similarly?

Recognizing What Is Happening, Is the First Step to Profiting From It.

To profit in trading, it's more important to recognize what's happening,

rather than to understand what's happening.

The strength of the rallies don't make sense to me based on logic. However, trends don't depend on logic. So, I dusted-off my copy of Trend Following and will simply ride the bucking

bronco.

But I Still Want to Know Why … Don't You?

Occam's Razor suggests that the simplest explanation is most likely to be correct. So, when markets move in a virtual lockstep (despite many unsettling global variables), let's look for simple explanations.

Here are a few ideas (ranging from silly to plausible).

- After watching the movie 2012, world leaders decided the one who dies

with the most toys wins. - Human nature is consistent across cultures.

- The recession is over, and we have begun a new global bull market.

- Something unusual is happening, and we just don't know what it is.

With consumers mostly out of the market, institutions figured-out how to buy and sell from each other, making relatively easy profits with minimal risk.

With consumers mostly out of the market, institutions figured-out how to buy and sell from each other, making relatively easy profits with minimal risk.- Governments agreed to temporarily suspend speculating in each other's

markets, other than in the normal course of business. - Governments and central banks agreed to cooperate. Don't fight the Fed, especially when it's a cartel of Feds.

From a Traders Perspective …

There are still many things to watch, from a trader's perspective, despite the strong correlation among markets. For example: divergence patterns can provide early indications of moves in either direction; relative strength comparisons can show which markets are more likely to over or under-perform; and volume spikes can indicate something unusual happening. Nonetheless, the simple observation is that markets are trending higher, so the safest assumption is that the trend continues until evidence proves otherwise.

My grandfather used to say: "you can fool some people, some of the time; but you can't fool all of the people, all of the time." He was not an exceptionally well-educated man, but he was a professional wrestler … so he knew something about stagecraft. My guess is that one of the actors breaks character soon. That tends to happen in most cartels.

Focus on the Global Economy as Debt Worries Rise.

Greece continues to stay in the news because a sustainable debt solution has not been agreed to and implemented. There are reports that smart-money is starting to bet against Greece.

America is not the next Greece, says Simon Johnson, MIT professor and former director of research for the IMF.

Have a good week.

Business Posts Moving the

Markets that I Found Interesting This Week:

- Nice Summary of Employment Trends and Statistics (Ritholtz)

- Is the Next Wave of Inflation on the Way? (Fortune)

- U.S. Bankruptcy Filings Rise to Highest Since 2005. (BankTech)

- Europe's Economic Woes: The PIIGS that Won't Fly. (Economist)

- Blog Post Insights on Gambling vs. Trading. (Derek Hernquist)

- More Posts

Moving the Markets.

Lighter Ideas and

Fun Links

that I Found Interesting This Week

- April Fools 2010: Here's a List of Some of the Better Jokes.

(TechCrunch) - Patent Power – Who's Winning the Innovation Game This Year? (Spectrum)

- Harvard Admits Record-Low 6.9% as Applicants Increase. (Bloomberg)

- How The New Healthcare Bill Will Control Your Big Mac Urges?

(ButThenWhat) - March Madness Team Comparison Data Visualization Tool.

(TableauSoftware) - More

Posts with Lighter Ideas and Fun Links.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=62e82373-7ee2-427f-8389-bae872622dc9)