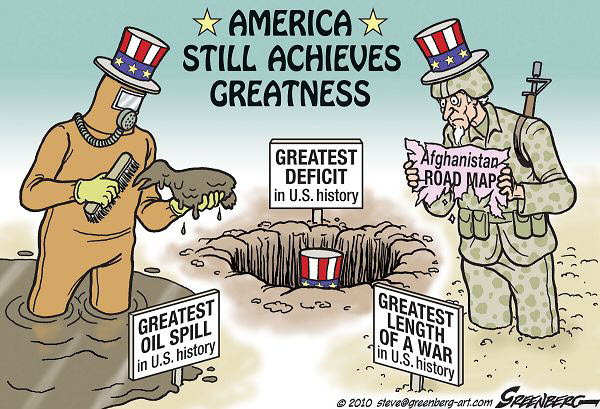

The deficit, the war, and the oil spill are still in the news. While this cartoon jokes about how America achieves greatness, I suspect it is a topic that will get more attention.

The Fed left rates unchanged, citing overseas threats and "developments abroad." Do you see that as a sign that cooperation is waning? Likewise, despite seeking further stimulus at the G20 Meetings this week in Toronto, the US found that world leaders were more concerned with trimming deficits.

Meanwhile, US Treasury Secretary Timothy Geithner told the BBC that the US can 'no longer drive global growth'; and the world

"cannot depend as much on the US as it did in the past". Instead, he said that other major economies would have to grow more for the global economy to prosper.

With that in mind, there are three big bearish macroeconomic stories hanging over the market:

- The sovereign debt issue in Europe.

- The slowing Chinese economy.

- The second leg down in housing.

The big question is – to what extent is the bad news already priced-in to the market?

Let's Look at the Charts.

The markets moved lower, as the economic news from housing

The markets moved lower, as the economic news from housing

to retail sales to revised Q1 GDP continues to confirm the weakness.

The weekly chart of the S&P 500 Index shows that we are still beneath the down-trend that started in late 2007. While price has held above the 1040 support zone (marked by the green highlight), last week's pattern (marked by the orange circle) is considered bearish. The week started higher, yet closed lower, than the prior week's range (this is called a Bearish Engulfing Pattern); and often signals a trend change.

However, short term oscillators are getting more oversold. As a result, there are probably lots of people looking for an oversold rally next week.

A Leading Indicator of Economic Activity is Dying-Up.

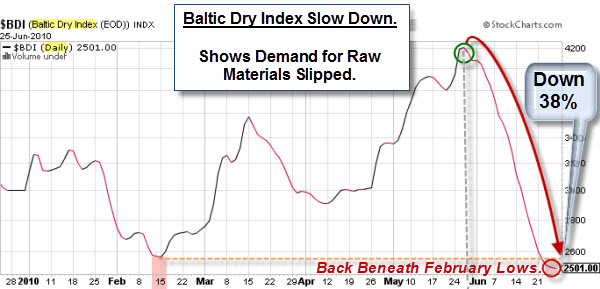

If you are looking for insight into global

supply and demand trends, the Baltic Dry

Index is one of the purest leading indicators of economic activity. It

offers a real-time glimpse at global raw material and

infrastructure demand,

as well as the supply of ships available to move this type of cargo.

Since making a short-term peak in late May (about a month after equity

markets peaked), the index has declined 38%, and

has just dropped below its February lows.

Business Posts Moving the

Markets that I Found Interesting This Week:

- The Caution of the Fed Comes With a Risk. Will It Spur Growth? (NYTimes)

- Overview of the Gangs Shaping Economic Policy and Dialog. (ReformedBroker)

- New-Home Sales Plummet 18.3% in May – A Record Low. (LATimes)

- Legendary Trader Victor Niederhoffer on Being Wrong. (Leavitt

Brothers) - Cold War Over: Russia Drops Capital Gains Tax to Attract Investment.

(BBC) - More Posts

Moving the Markets.

Lighter Ideas and

Fun Links

that I Found Interesting This Week

- Why N Korea Seeks $75 Trillion In Compensation From U.S.? (Australian

News) - Runaway General: the Rolling Stone Article That Took Down

McChrystal. (RS) - Texas Red-Light Camera Revenue Becoming Big Business. (TexasTribune)

- Congress To Debate Cellphone Tracking. They Know Where You Are. (Forbes)

- Learn to Talk Like Yoda: Enjoy this, you will. Fun, it is. (YodaSpeak)

- More

Posts with Lighter Ideas and Fun Links.

Nice Read!

Of course, the entire market is watching this H&S, which can lead to a “failed” pattern. The battle lines have been drawn and 1040 continues to be the line it the sand to watch..

Can’t wait to see how this shakes out..

Cheers!

Frank