What Does Wall Street Sentiment Show?

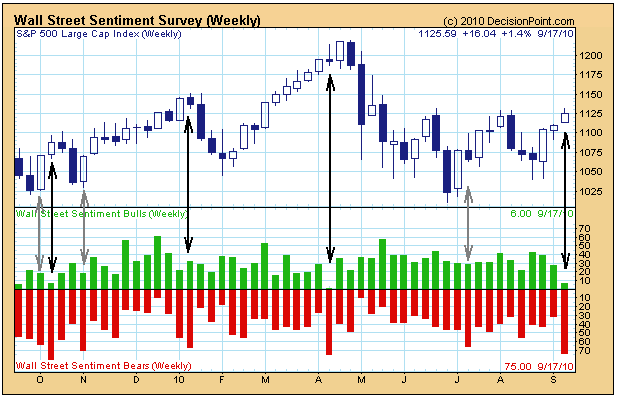

The weekly Wall Street Sentiment Survey is unique because the poll is taken after the close on Friday, and those polled are asked only to predict where the market will close as of the end of the following week — up, down, or neutral (no opinion). In other words, everyone is on the same page, and only short-term projections are solicited.

Carl Swenlin notes that bearish readings of greater than 65% often precede price tops by a week or two. Reliability seems to be enhanced if a high percentage of bears occurs during an advance.

The most recent reading of 75% bears has occurred during a modest advance, so it is probably a good idea to curb bullish enthusiasm.

Business Posts Moving the Markets that I Found Interesting This Week:

- Volcker is Pessimistic, Says 'Financial System Is Broken'. (Dealbook)

- The Housing Crisis: A New Wave Of Distressed Home Sales. (WP)

- Do B-of-A Layoffs Signal Weakness in Investment Banking and M&A? (Fox)

- Blockbuster Files for Bankruptcy. (Dealbook)

- Dell Looks For $60 Billion in Revenue This Year. (Reuters)

Lighter Ideas and Fun Links that I Found Interesting This Week

- Bill Gates Tops Forbes 400 Ranking of Richest Americans With $54 Billion. (Bloomberg)

- Is that Bill Gates Mug-Shot Hiding in Outlook 2010? I'll Bet He Didn't Know. (arstechnica)

- Women Apologize More Frequently Than Men: Here's Why. (ScientificAmerican)

- Michael Douglas Cashes-In Again on No. 1 'Wall Street'. (USAToday)

- Myths That Everyone Believes. Well, not "Everybody" … (MyDoubts)