President Obama promised to roll-out “new ideas” to boost growth and spur hiring during an economy-focused trip to the Midwest. He says the economy is moving in “the right direction; we just have to speed it up.”

Consequently, the President is asking Congress to help small businesses by passing legislation that includes $12 billion in tax breaks and $30 billion worth of aid to free up credit. The question, of course, is whether the White House can turn these ideas into a political reality.

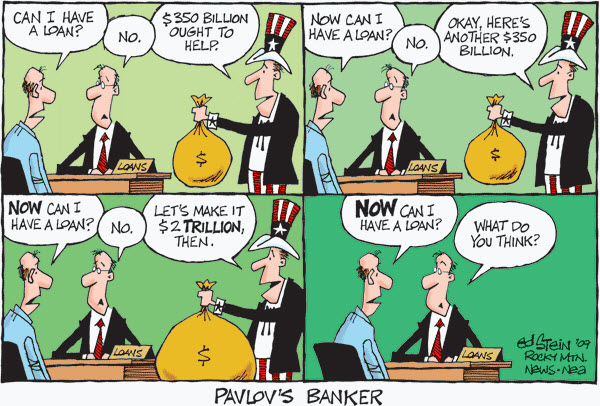

Seems to me I've seen this play a few times.

Ed Stein reminds: "Every time these guys refuse to lend money, the government ponies up more billions. If it were me, I'd keep playing that game until the Treasury was empty, which apparently is exactly what the bankers are doing. There's a reason why they're rich."

Market Commentary

The markets continued higher on light trading. We are coming into the top of the consolidation zone.

There is not much to say, other than we are approaching a clear decision-zone. A sustained move above the 1040 level will most likely trigger some real buying.

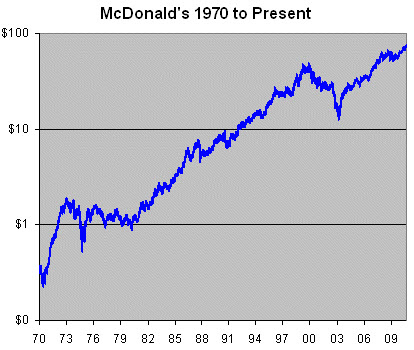

Sign of the Times: McDonalds Hitting All-Time High.

Here is something we haven't seen often lately, a stock hitting all-time highs. Well, McDonalds recently hit $75.13 which is a long way from the $13 it hit in 2003. Must be the special sauce?

Successful Patterns.

Elephants leave tracks … and smart traders follow the big money.

Large traders like governments, sovereign wealth funds, or a mutual fund can affect markets while they buy or sell; however, when they're done, some other group's strategy becomes the dominant force.

It is important to understand "who is in control" … not necessarily why they are trading.

That means you don't have to figure out every bit of information or rationale behind their strategy in order to make money.

For example, if you were about to walk into a movie theater, but were suddenly confronted with hundreds of people running in the other direction screaming, you don't have to understand exactly why it's happening in order to respond intelligently.

On a superficial level, that's the basis of trend following. It is also an example of pattern recognition.

You Can Find Patterns Everywhere.

If you don't believe there is a consistent formula for success, then you should watch this collection of songs made-up from the same four chords. The video is from an Australian Comedy group, called "Axis of Awesome".

Quite clever.

Business Posts Moving the Markets that I Found Interesting This Week:

- Goldman's Hedge Fund Factory Closing Due to New Regulatory Limits? (MarketWatch)

- U.S. Economy Slips to 4th in W.E.F.'s Competitiveness Rankings. So Who's #1? (ABC)

- Beware of Greeks Bearing Bonds: Another Great Michael Lewis Piece. (VanityFair)

- The Scariest Boring Phrase In Finance: "Sovereign Credit Spreads Are Widening". (NPR)

- MBAs Are For Wusses: In Israel, Start-Ups Fight for Army Veterans. (Economist)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Putting Things in Perspective: The World's Oldest Living Things. (TED)

- Breath Like the Rest of the World: Fresh Air for Sale in Hong Kong. (GreenBlog)

- Army Yoga: Making Soldiers Fit to Fight Without the Situps. (NYTimes)

- Re-Thinking American Options About Iran. (Stratfor)

- Mate Selection: Identifying Which Dance Moves Make Men Attractive to Women. (Economist)

- More Posts with Lighter Ideas and Fun Links.

I’m developing a fully automated robot trading software, that trades all the best opportunities from the stocks Dax market.

At this stage I am building the knowledge base based on facts and rules.

I am a programmer who knows nothing about trading, but with the help of experts, I am building my knowledge base.

Facts & Rules :

I trade chart patterns (*1) like Tim Grittani, Tom bulkowski, William O’Neal, Dan Zanger, Mark Minervini…

Experts say to use moving averages to improve performance.

My period of analysis is 17 years, I need to cover several cycles.

I work with 25 tickers from Dax, a liquid market with low commissions.

Take profit average: 3.62

Stop loss average: 3.06 (Win/Loss 1.18)

Maximum take profit: 11.5

Maximum stop loss: 6.5 (Win/Loss 1.77)

Experts say the optimal ratio of wins to losses shoulde be 2:1 !

My time stop is 7 days !

Experts say not risk per transaction more than 2% of total capital !

I found 425 Bullish Flag patterns in 17 years, for 25 tickers (*2) !

Experts say that 30 trades is a minimum to suggest statistical significance !

First result: if I trade 35 times a year, I get an average year profit of 37.82% (*3), deducting commissions from the broker!

Questions for the expert:

(*1) Is this a profitable strategy ? Do you work with another strategy more profitable ?

This is profitable but you work with another pattern ?

(*2) Is this value statistically significant ?

(*3) Taking into account the results of professional trader, is this first result a low, medium ou high value ?

Thank you,

Antonio

AI programming student