An increase in Venture Capital funding is typically a good indicator that more growth is coming.

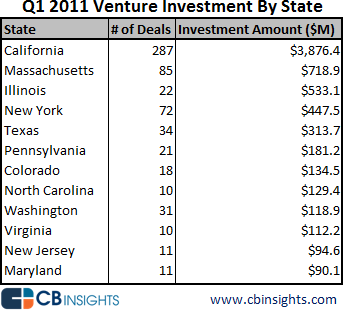

CB Insights Quarterly Venture Capital Report for Q1 2011 highlights the recent positive momentum. It reports about $7.5B invested across 738 deals. The following chart shows the top states based on deals and dollars.

The full chart details Q1 deals in 39 different states.

So, who is doing the deals?

Top Venture Capital Firms of 2011 Based on Deal Activity

Kleiner Perkins was the most active venture capital firm in Q1 2011 participating in 23 new and follow-on financings in US-based companies followed closely by New Enterprise Associates. It was a busy quarter for many VC firms with 27 firms participating in at least 7 financing deals in the quarter. Note: You can get the entire Q1 2011 63 page report here.

Below is the list of the top dozen most active VC firms in the US.

| Investor | # of deals | Rank |

| Kleiner Perkins Caufield & Byers | 23 | 1 |

| New Enterprise Associates | 20 | 2 |

| 500 Startups | 14 | 3 |

| First Round Capital | 14 | 3 |

| Sequoia Capital | 14 | 3 |

| SV Angel | 14 | 3 |

| Charles River Ventures | 12 | 7 |

| Bessemer Venture Partners | 11 | 8 |

| Spark Capital | 11 | 8 |

| DAG Ventures | 9 | 10 |

| Founder Collective | 9 | 10 |

| General Catalyst Partners | 9 | 10 |

See the entire list here.