After much speculation, Groupon (GRPN) went public last Friday. Its first day of trading ended with the stock closing 31% above its offering price.

Groupon's successful IPO raises a bunch of questions. What does it say about the market? Do you care that they floated less than 5% of the company?

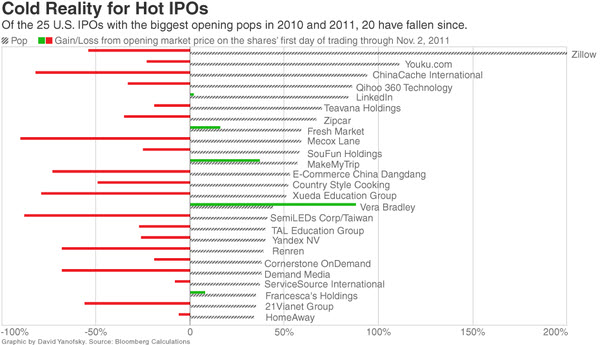

Another question is how other hot IPOs have fared recently?

What comes after a blockbuster IPO tends to be less pretty. The chart, above, shows the post-IPO performance of 25 hottest offerings of 2010 and 2011. There’s a lot of red: after the initial “pop” (which is the jump from the offering price to the open), 20 of those 25 tanked. Many have fallen 50 percent from their first day opening price in the stock market* (one high profile example: Demand Media, down 68 percent since its January debut), a few more than 80%.