Does a market rally in January imply anything for the rest of the trading year? "As goes January, so goes the year." This particular phenomenon is what is referred to as the January Barometer.

Is it true? I don't know … but it is fun to examine.

Many reputable services report the January Barometer's recent-history success rate at around 75%; so it is at least worth noting.

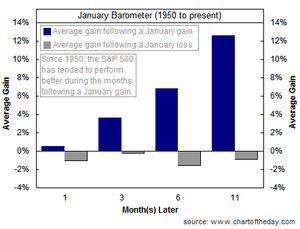

I was going through some past research and found this chart from Chart of the Day from 2009. It illustrates that the S&P 500 has performed much better (on average) during the months following a January gain. The chart is a few years old, but recent years have followed this trend as well.

John Murphy has a slightly different perspective; he says that what the market does during the first week of the new year often gives a clue about direction for the remainder of the year.

Murphy cites the Stock Trader's Almanac, "S&P gains during January's first five trading days preceded full-year gains 86% of the time". The predictive ability of the month of January is nearly as impressive. "The January Barometer predicts the year's course with a .741 batting average. 12 of the last 14 post-election years followed January's direction" (Almanac).

While the January barometer has a good record of prediction, Carl Swenlin still puts it in the "for what it's worth" column because, while it is interesting to note, it might simply be coincidental. Likewise, Business Insider questioned the significance of this indicator in a note called "Don't Be Fooled By All Of The So-Called Market Wisdom".

Nevertheless, we had a good start to that first week of January here in 2012 – and it has continued. Let's hope it keeps up.