I went to a Metroplex Technology Business Council luncheon this week. The topic was Venture Funding. The room was packed (and the content was good), but what surprised me was the age of the entrepreneurs in the room.

The picture below shows it; but let's just say there was a lot of 'experience' in the room.

How is Venture Doing?

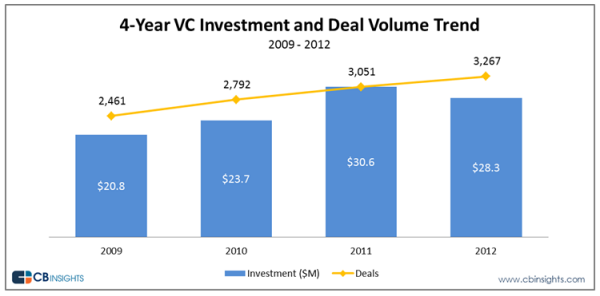

Deal activity saw a multi-year high in 2012. However, funding fell from 2011’s $30+ billion level.

According to CB Insights, venture capital funding fell to $28.3 billion in 2012 (-7.5% vs '11), while financing activity increased (+7.0% vs '11).

Where Did the Deals Get Done?

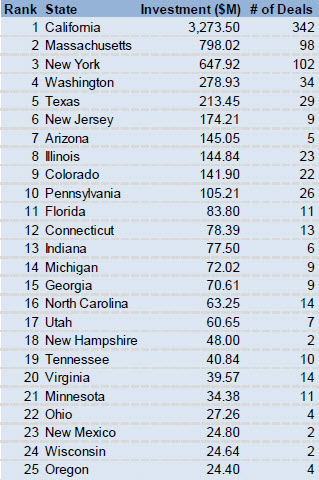

California remains at the top of the list for venture capital activity, followed by

Massachusetts and New York. Here’s a look at the top 25 states in terms

of venture capital investing during the fourth quarter.

Who Did the Funding?

The most active firm during the year was New Enterprise Associates, followed by Kleiner Perkins Caufield & Byers, Google Ventures, Andreessen Horowitz and First Round Capital.

So what do you think, will 2013 be a year that we see more deals?