Before its IPO, last Thursday, Twitter reacted to the strong demand for its initial public offering by raising the price range for its shares (from $17 to $20, as initially planned) to $26 per share.

As a result, Twitter raised over $1.8 Billion … thus valuing the microblogging platform at over $14 Billion.

The seven-year-old social network saw its stock price soar from an

initial public offering price of $26 to $44.90, a 73 percent increase.

After one day of trading, Twitter already had a greater valuation than

currently hot tech companies like Netflix and LinkedIn.

via statista.

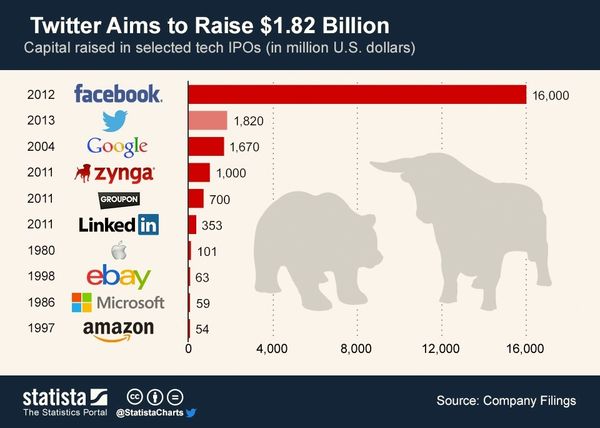

Even though Twitter’s initial public offering appears small compared to Facebook’s blockbuster IPO a year ago, it is still larger than many high-profile tech IPOs over the past few decades.

When Amazon, a company now worth $163 billion, went public in May 1997, the online retailer raised no more than $54 million. Even Google's IPO, arguably the second-largest internet IPO behind Facebook’s, raised less capital than Twitter is now planning to.

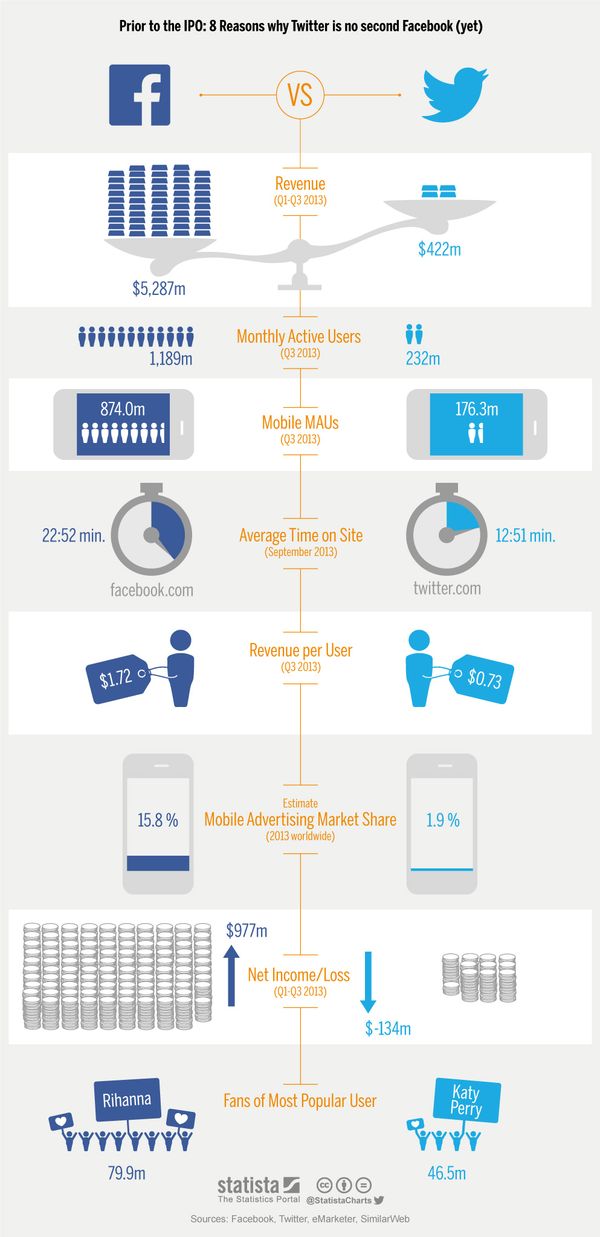

As impressive as Twitter's Initial Public Offering was, here are some reasons that it was different (and smaller) than Facebook's IPO.

via statista.