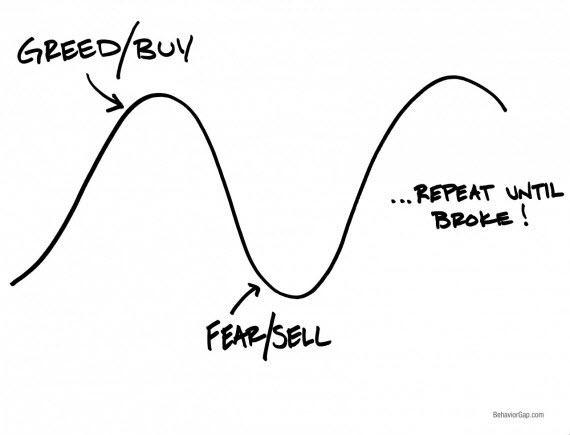

Few investors are good at swing trading — meaning, they're not good at predicting short-term swings in the market.

Recently, BusinessInsider observed that more often than not, investors find themselves buying high and selling low. And when the market starts selling off sharply, investors will panic, sell their own shares, and sit on the sidelines.

Here is a great way to visualize that.

via BehaviorGap.

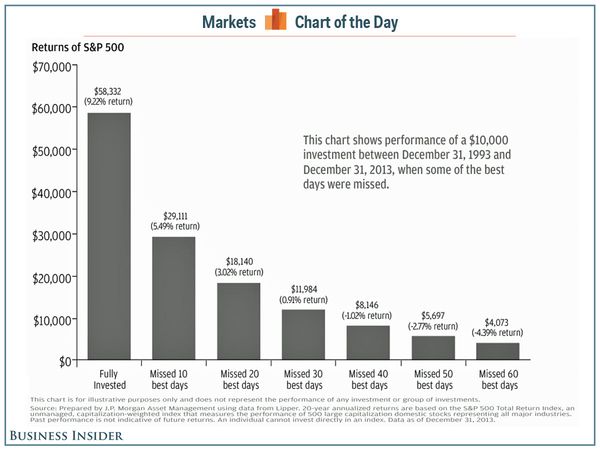

Unfortunately, some of the biggest one-day upswings in the market occur during these "tough to trade" volatile periods.

In its 2014 Guide to Retirement, JP Morgan Asset Management illustrates what can happen to investor returns when they miss out on these good days.

via BusinessInsider.

For instance, if an investor stayed fully invested in the S&P 500 from 1993 to 2013, they would've had a 9.2% annualized return.

However, if trading resulted in them missing just the ten best days during that same period, then those annualized returns would collapse to 5.4%.

In this trading methodology, missing 'big win' days does so much damage because those missed gains aren't able to compound during the rest of the investment holding period.