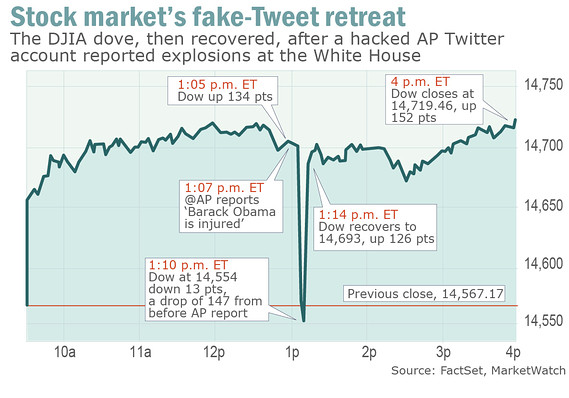

You probably heard that a fake Tweet (claiming that something happened in Washington DC) caused the market to have a mini flash crash this past week. Within minutes of that Tweet on Tuesday, more than $130 billion disappeared from the value of US stocks trading on Wall Street.

Who is to blame … hackers, Twitter, or perhaps algorithmic traders? I don't think so.

After looking at the data, here is a different perspective on what happened … and what I think it means for the future.

Let's assume that a trading algorithm was able

to identify a potential risk (or opportunity) and make a trade based on that information. Once that trade becomes visible to other traders through the open-market system, it's going to trigger a series of causes and effects.

This is no different than when a local on the floor of an exchange places in order during slow market periods to clean out the stops. A spike down beneath people's risk tolerance creates a desire to sell. However, if there is no further selling pressure, the market will rise as traders suspect a 'bargain'. Does that constitute is a micro flash crash also?

The point is that markets are becoming faster and more volatile. It doesn't make sense to complain every time something like this happens. It's going to happen with increasing frequency.

This is now part of the market; consequently, it is time to figure out what to do with it. Some traders will move to faster and more responsive algorithms. Other traders will increase the time-frame that they focus on in order to filter out the "noise" and small variations like this constitute.

Whining about it and calling for increased regulation may be missing the point as well. Why? Because there is a financial incentive for algorithmic traders to become better at correcting these errors themselves. Frankly, it's too expensive to be wrong for long (especially when your trading large-size). As a result, the algorithms are going to get better at the 'two steps forward, one step back' testing and evaluation process. It's inevitable.

Trading isn't about predicting the future. It's about calculating the probabilities better. By doing this you can know faster and act

faster. This will likely result in smaller errors – and (if you care) the markets will seem more orderly. Nevertheless, what it really means is more ways to win for people who can spot the opportunities quick enough to take advantage of them.